Have tax accountants been buying bazookas? Are cows receiving small-arms training?

When the corporate media asked the IRS why it needed automatic weapons, millions of rounds of ammunition and heavily armed staffers trained in the “use of deadly force,” they said it was for “administrative reasons.”

Why, for instance, would the IRS need armored vehicles, flash-bang grenades loaded with tear gas, and .40-caliber submachine guns?

The IRS has been stepping up its purchases of guns and ammunition even more over the last two years, gobbling up nearly $700,000 in ammo in early 2022. That bulk purchase prompted Representatives Matt Gaetz (R-FL) and Jeff Duncan (R-SC) to introduce the “Disarm the IRS Act,” to prohibit the IRS from buying ammunition. Of course, this bill was dead on arrival…

The U.S. Department of Agriculture has also purchased hundreds of .40-caliber submachine guns, presumably for making raids on independent food producers.

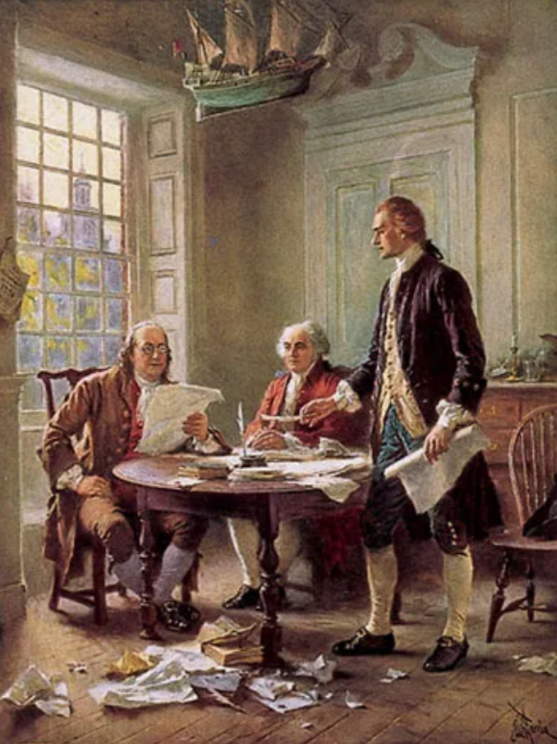

Try to imagine what John Adams and Ben Franklin and Thomas Paine would have said, if in the wake of the freshly signed Constitution, America’s first President, George Washington, had created a huge tax-collection agency and armed it with muskets and cannons.

There are solutions. Each year, the federal government could create, out of thin air, say, 1% of the nation’s GDP, and Congress could spend it…

Thus ending federal taxes. Thus ending the IRS.